RISK 2

Serious Illness Risk

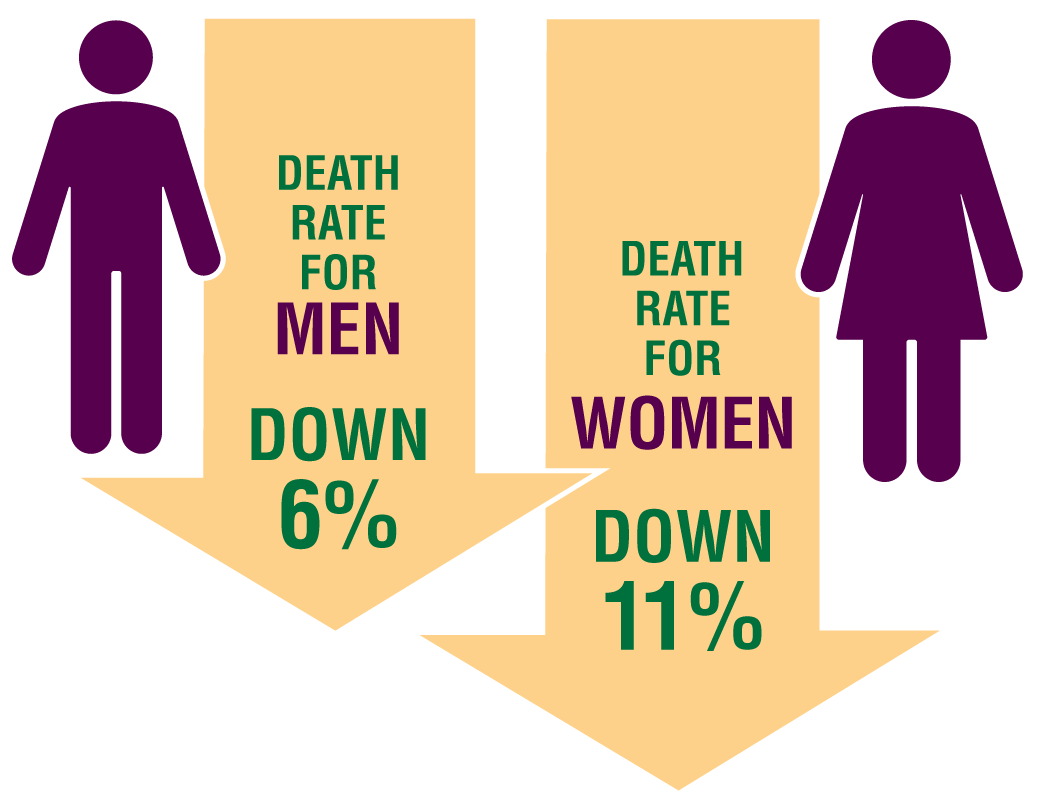

The good news is that Baby Boomers are living longer than the previous generation. The bad news is, they aren’t necessarily living healthier.

Did you know that a life insurance death benefit could help while your clients are living? An accelerated death benefit can provide cash for a serious illness without liquidating assets. It allows the policy owner to receive a portion of the death benefit if the insured has a qualifying illness.1 Plus, it’s an unrestricted benefit – the money can be used for any purpose.

How do your clients plan to pay for extended nursing care for a chronic condition or the high cost of treatment if they are diagnosed with a critical illness like cancer?

- ‹ prev

- next ›

- 1

- 2

- 3

- 4

- 5

- 6

- 7

Key Point

People are living longer, but not necessarily healthier. Would your clients need to liquidate assets to pay today’s high cost of care?